Drones for Insurance Inspections: The Future of Claims Adjudication

Last Updated on September 12, 2023 by Matt Gardner

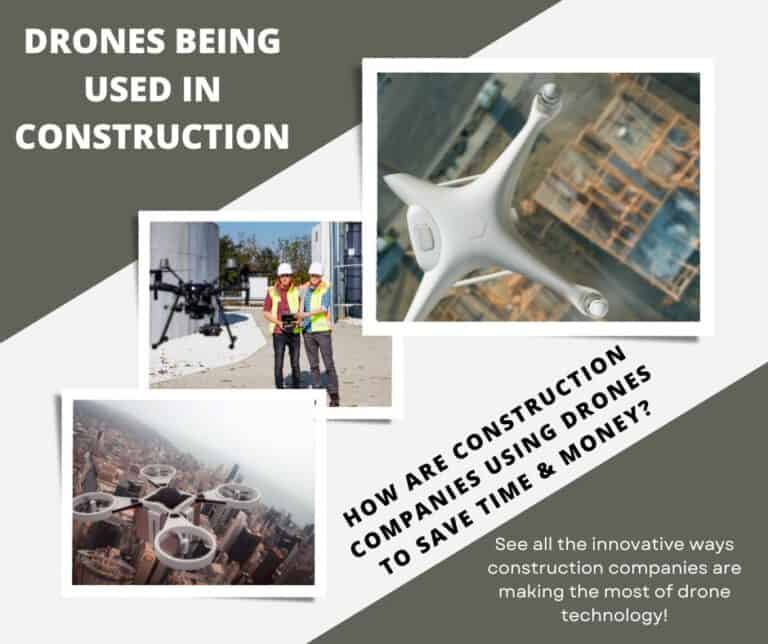

As a contractor in the building industry, you know that insurance inspections can be time-consuming and tedious.

In addition to the safety risks posed by ladders and other equipment, there is also the risk of inaccurate data collection due to human error.

That’s why drones are becoming increasingly popular for insurance inspections. Drones offer a safe, efficient, and cost-effective way to conduct insurance claim inspections.

They provide high-resolution imagery that can be used to assess damages quickly and accurately. Plus, they’re much faster than traditional methods of inspection.

In this blog post, we’ll explore how drones are being used for insurance inspections and provide product recommendations for the top 3 drones on the market for drone inspections today.

What Are Insurance Inspection Drones?

Insurance inspection drones, otherwise known as unmanned aerial vehicles (UAVs), are drones used to take photos and capture other data in order to inform an insurer’s decision about whether or not to pay out on a claim.

They are typically equipped with cameras that allow them to take detailed images from multiple angles which can then be used to assess damage more accurately than traditional methods of inspection.

The Challenges with Traditional Insurance Inspections

Before I dive into the benefits of using drones for insurance inspections, let’s take a moment to discuss the common issues that we face with traditional insurance company inspections.

- Lengthy wait times: Traditional inspections require an inspector to come to the site, which can take days or even weeks to schedule.

- Missed deadlines: Traditional inspections can cause delays in the project timeline, leading to missed deadlines and potential financial losses.

- Inaccurate assessments: Traditional inspections rely on human judgement, which can sometimes be subjective and lead to inaccurate assessments.

Benefits of Using Drones for Insurance Inspections

There are many benefits associated with insurance carriers using drones for insurance inspections:

- Safety – Drones reduce the risk of injury by eliminating the need for ladders or other dangerous equipment when conducting an inspection. This makes it safer for both inspectors and homeowners alike.

- Speed – Drones can cover large areas quickly and efficiently, allowing insurers to process claims much faster than they would with traditional methods of inspection.

- Accuracy – The high-resolution imagery captured by drones provides more accurate data than traditional methods of inspection, allowing insurers to make better decisions about whether or not to pay out on a claim.

How Can Drones be Used for Insurance Claim Inspections?

If you’ve ever had to file an insurance claim, you know how tedious the process can be.

Waiting for a human inspector to assess the damage can take days, or even weeks, leaving you in limbo.

This is where drones come in – they can speed up the process and provide a more accurate assessment of the damage. Here are some of the ways that drones can be used for insurance claim inspections:

Quick Assessment of Damage

Drones can be deployed quickly to assess the damage after a natural disaster or accident, such as a storm or fire.

Instead of waiting for human inspectors to arrive, drones can provide real-time images and data, allowing insurance companies to make faster and more informed decisions.

More Accurate Assessment

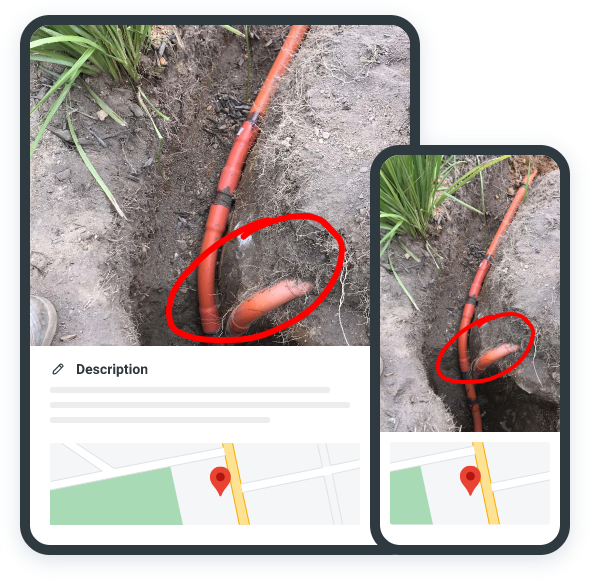

Drones can capture high-resolution images and videos of the damaged property, providing insurance industry with a more accurate assessment of the damage than human inspectors.

This can help prevent disputes between insurance companies and claimants, reducing the time and cost involved in resolving claims.

Fraud Detection

Drones can also be used for fraud detection, an issue that has plagued the insurance industry for years.

By using drones to capture high-resolution images and videos, insurance companies can identify potential fraudulent claims.

This is especially useful to assess property damage, investigate car accidents, and monitor suspicious claims, as insurers can identify fraudulent claims more quickly and accurately, saving time and money in the process.

Safer Inspections

Some types of inspections, such as roof inspections, can be dangerous for human inspectors. Drones can capture images and data from a safe distance, reducing the risk of accidents and injuries.

Cost-Effective Solution

Using drones for insurance company and claim inspections can help to reduce operational costs, as it reduces the need for human inspectors to travel to the site of the damage. This can save insurance companies and claimants time and money.

How Can Drones be Used by Insurance Companies to Assess Risk?

Insurance companies are always on the lookout for ways to assess risk more accurately, and drones offer a unique solution to this challenge.

Here are some of the ways that insurance companies can use commercial drones to to assess risk:

Property Inspections

Insurance companies can use drones to conduct property inspections, providing detailed images and data to assess the condition of buildings, infrastructure, and land.

This same drone technology can help insurance companies identify potential risks and hazards, such as leaks, damages, or structural issues.

Natural Disaster Assessment

Drones can be deployed quickly after a natural disaster, such as a hurricane or earthquake, to assess the damage and potential risks.

Insurance companies can use the data collected by drones after natural disasters to adjust their risk assessments and provide faster and more accurate claims processing.

Risk Assessment of Remote Locations

Some properties, such as oil rigs or offshore wind farms, are located in remote and hard-to-reach areas.

Drones can be used to inspect these locations, providing insurance companies with a more accurate assessment of the risks involved.

Surveillance of High-Risk Areas

Insurance companies can also use drones to conduct surveillance of high-risk areas, such as construction sites or areas prone to theft or vandalism.

This drone usage can help insurance companies identify potential risks and adjust their policies accordingly.

How the Insurance Industry is Embracing Drone Technology

The insurance industry is no stranger to adopting new technologies to improve efficiency and customer service.

Drone technology is no exception. Insurance companies are starting to embrace drone technology to improve their risk assessments, reduce costs, and provide better service to their customers.

Drone Use in Insurance Inspections

Insurance companies are increasingly using drones to conduct property inspections. Drones provide a fast and cost-effective way to inspect properties and gather data that is necessary for accurate risk assessments.

This technology is especially useful for inspecting properties that are difficult to access or are located in areas prone to natural disasters.

Insurance Claims Processing

Drones are also being used by insurance companies to process claims more quickly and accurately.

After a natural disaster, drones can be used to assess the damage to a property, which helps insurance companies process claims more quickly and accurately.

This can be especially helpful in regions that are prone to natural disasters, such as coastal areas that are vulnerable to hurricanes.

Acceptance of Drone Technology

The switch to using drones for insurance inspections is still a relatively new trend, but it is gaining acceptance in the industry.

While some insurance companies may still prefer manual inspections, many others are embracing this new technology as a way to improve their efficiency and accuracy.

As drones continue to become more advanced and affordable, it’s likely that even more insurance companies will adopt them for their risk assessments and claims processing.

In conclusion, the insurance industry is starting to embrace drone technology as a way to improve their risk assessments, reduce costs, and provide better service to their customers.

While the switch to using drones for insurance inspections is still relatively new, it’s gaining acceptance in the industry and is likely to become more widespread in the future.

Product Recommendations: Top 3 Drones For Insurance Inspections

So by now you’re probably wondering which drones are the best for the job.

With so many options on the market, it can be overwhelming to choose the right one. But don’t worry, we’ve got a few recommendations to get you on your way.

In this section, we’ll provide detailed reviews of a few of the top recommended commercial drones for insurance claim inspections.

We’ll cover the features, pros, and cons of each drone to help you make an informed decision about which one to choose for your insurance inspections.

So, let’s get started!

1) DJI Phantom 4 Pro

The DJI Phantom 4 Pro is a good drone for insurance inspections because it is lightweight and portable.

It also comes with a built-in camera, allowing you to capture high-quality images from multiple angles quickly and easily.

Additionally, it has obstacle avoidance sensors that help prevent collisions while flying in tight spaces or near obstacles such as trees or buildings.

Pros: Lightweight & Portable; Built-in Camera; Obstacle Avoidance Sensors

Cons: Limited Flight Time; Expensive

2) Yuneec Typhoon H Pro

The Yuneec Typhoon H Pro is another great option for insurance inspections because it offers superior flight stability thanks to its 6 rotors which provide greater control in windy conditions compared to other models with only 4 rotors.

It also features an advanced obstacle avoidance system that helps prevent collisions while flying near obstacles such as trees or buildings.

Additionally, its long battery life allows you to cover larger areas without having to worry about running out of power mid-flight.

Pros: Superior Flight Stability; Advanced Obstacle Avoidance System; Long Battery Life

Cons: Expensive; Limited Range

3) Parrot Anafi FPV Drone Kit

The Parrot Anafi FPV Drone Kit is ideal for insurance inspections because it offers first person view (FPV) capabilities which allow you to see what your other drone operator sees in real time as you fly it around a property looking for signs of damage or wear and tear from afar without having to physically enter the premises yourself.

Additionally, its foldable design makes it easy to transport from one job site to another without taking up too much space in your vehicle or backpack.

Pros: First Person View Capabilities; Foldable Design; Easy To Transport

Cons: Limited Battery Life; No Obstacle Avoidance System

On average, punch list software can cost anywhere from $10 to $50 per user per month for a basic subscription, with more advanced or enterprise-level packages often costing several hundred dollars per month.

Wrapping Up

Drones have revolutionized the way insurers conduct their claims adjudication process by providing them with detailed imagery that allows them make better decisions about whether or not they should pay out on a claim quickly and accurately while reducing safety risks associated with traditional methods of inspection such as ladders or scaffolding equipment .

We hope this blog post has provided some useful insights into how drones are being used for various insurance claims and inspections along with product recommendations so you can find the right drone solution for your needs!

Further Recommended Reading

If you’re interested in learning more about using drones for insurance inspections, there are plenty of resources available online. Here are a few articles and websites we recommend checking out:

- The Benefits of Using Drones for Insurance Claims Inspections – This article from Property Casualty 360 provides an overview of the benefits of using drones for insurance claims inspections.

- FAA Guidelines for Commercial Drone Use – If you’re planning on using drones for commercial purposes, it’s important to familiarize yourself with the Federal Aviation Administration has guidelines for commercial drone use. This website provides all the information you need to know.

- Drone Inspection Services for Insurance Companies – This website from DroneDeploy offers a comprehensive drone inspection service for insurance companies.

- Insurance Companies Using Drones: Here’s What You Need to Know – This article from UPC Insurance provides an overview of how insurance companies are using drones and what you need to know if you’re considering using them for your business.

These resources should give you a good starting point for learning more about using drones for insurance inspections.

Remember, if you’re planning on using drones for commercial purposes, it’s important to follow the Federal Aviation Administration’s guidelines for commercial drone use. By doing so, you can ensure that you’re using drones safely and legally.